Research Areas

New Research

Tax Compliance

Covid Policy

Income Inequality

Tax Progressivity

Income Mobility

Tax Credits/Policy

Health/Pensions

Curriculum Vitae

Google Scholar

Do Marriage Tax Penalties Cause Delayed Marriage Reporting?

Summary: Couples can face higher taxes when filing as a married couple rather than as unmarried individuals. These marriage penalties may motivate newlyweds to delay reporting their marriage on tax returns. Linking marriage records to federal tax returns, we show marriage penalties are correlated with delayed marriage reporting. Over 2% of newlyweds misreport their marital status. Misreporting rates increase to 14% when marriage penalties reach $8,000. Misreporting and large marriage penalties are more prevalent among couples with similar earnings and who claim earned income tax credits. Misreporting couples often start correctly reporting when marriage penalties become marriage bonuses.

I. Introduction

Married couples may misreport their marital status on tax returns to avoid marriage

penalties. A couple faces a marriage penalty if they owe more income tax filing as married

than they would owe if filing as unmarried. For a couple facing a marriage penalty, misreporting their marital status can decrease their income taxes. Using administrative

marriage records from Minnesota linked to federal tax returns, we calculate marriage

penalties among newlyweds and document marital-status misreporting. We find a strong,

positive relationship between marriage penalties and marital-status misreporting.

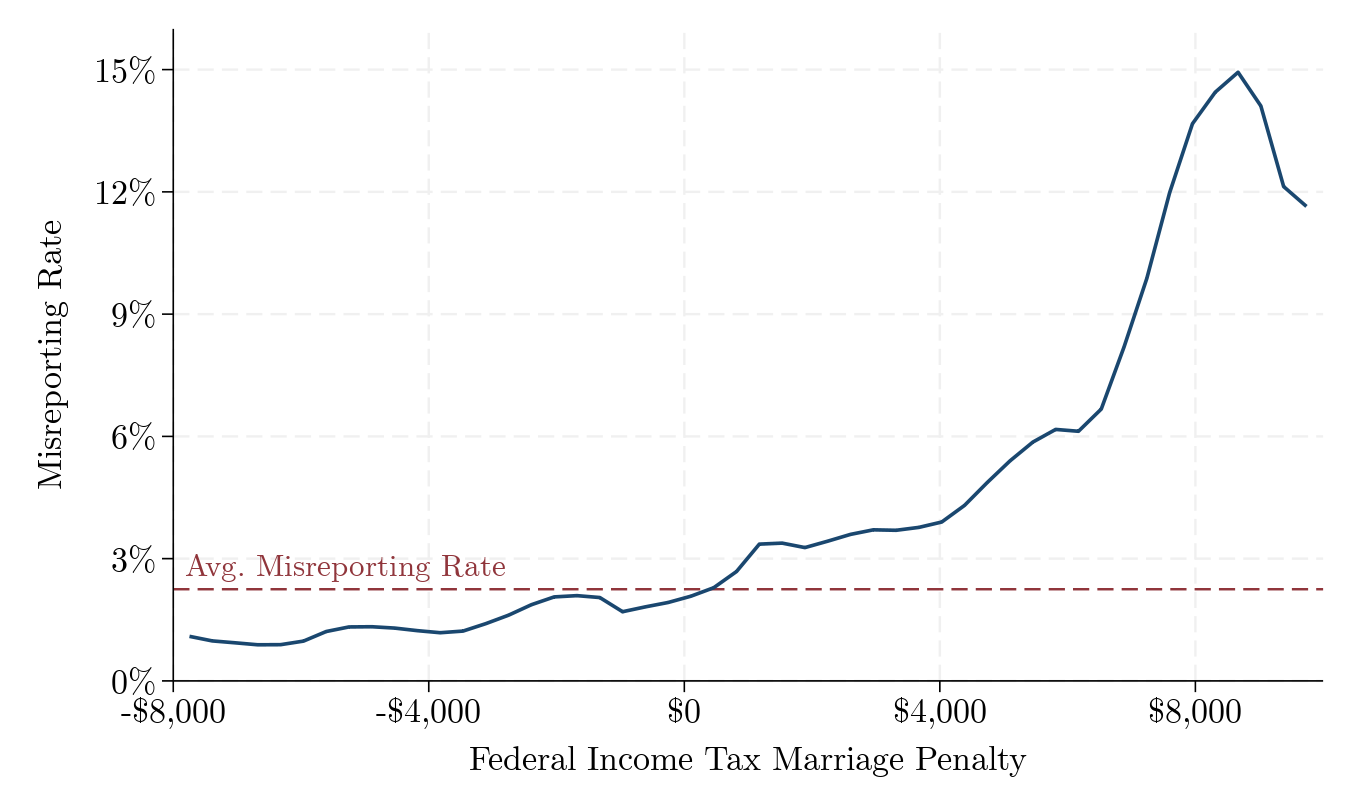

Figure 1: Marital-status misreporting and marriage penalties among newlyweds, 2001-2022

Our analysis provides four main contributions. First, this paper documents maritalstatus misreporting as a novel source of tax noncompliance related to marriage penalties.

Second, linked marriage record and tax data show how actual (not reported) marriage

timing varies with marriage penalties, making these data better suited to analyzing the

impacts of marriage penalties than prior studies that relied on self-reported marital status.

Administrative tax data also provide more credible marriage penalty estimates than studies

using survey data—where estimated EITCs can be understated by one-third (Meyer et al.

2022). Third, while state income taxes were ignored in prior studies, we consider total

(federal and state) marriage penalties. State taxes reinforce our main result, widening the

average marriage penalty gap between compliant and misreporting newlyweds from about

$1,000 to $1,200. Finally, we find cross-sectional and panel-based evidence of strategic

misreporting. Couples who misreport and then become compliant, tend to do so

immediately upon no longer facing a marriage penalty. That is, strategic behavioral

responses are seen not only in the year of marriage—where newlywed misreporting rates

increase with marriage penalties—but also in later years, when misreporting couples start

correctly reporting their marriage.

II. Policy Background and Prior Literature

A marriage penalty occurs when a couple owes more income tax when filing a return as

married, while a marriage bonus occurs when they owe less. A couple married on

December 31 must file as married that tax year. While some unmarried couples file as

married, in this study, we only consider marital-status misreporting as a married person

filing as single or head-of-household instead of married filing jointly or married filing

separately.2

A. Prior Literature on Marriage Penalties

1. Marriage penalty estimation issues. Strong assumptions are needed for standard

marriage penalty estimates because of unobserved spousal splits for jointly reported items

(Bull et al. 1999; Holtzblatt and Rebelein 2000). This results in uncertainty for marriage

penalty estimates, especially when dividing dependents, capital income, and deductions

between spouses. This issue, however, does not apply to our marriage penalty estimates for

misreporters because we combine the returns of separately filing spouses instead of

dividing the return of jointly filing spouses.

B. Marriage Mismeasurement and Administrative Data Linkages

Our linked data also highlight broader implications of marriage mismeasurement. Survey

data include many misreported marriages, but are the basis for estimates of the decline in

marriage rates (Kearney 2025) and estimates of the causal impact of housing costs on

marriage (Bowmaker and Emerson 2015; Chiocchio 2025) and marriage on fertility

(Hayford, Guzzo, and Smock 2014; Smith 2019). While marriages are modestly

underreported in tax data, marriages appear to be widely overreported in survey data.

Linking individuals across the Current Population Survey and tax return data suggests a

10% higher net marriage rate in survey data.8

III. Data Construction and Marriage Penalty Calculation

This study uses administrative data from state marriage records and federal tax returns. The

state marriage records cover almost all marriages in Minnesota. The tax return data are

from IRS administrative data containing the population of federal tax returns and

information returns (e.g., Forms W-2). This section describes how we link these data,

create the sample to cover the 22-year period from 2001 to 2022, and calculate marriage

penalties by comparing federal income tax liabilities of actual returns and returns with

counterfactual filing statuses. The sample includes over two hundred thousand couples and

enables analysis of the relationship between marital-status misreporting and marriage

penalties.

A. Linking Marriage Records to Tax Data

Marriages conducted in Minnesota are publicly available on the Minnesota Official

Marriage System (https://moms.mn.gov). Marriage records date back to the early 19th

century and are continuously updated. Although these records are public, the data cannot

be downloaded directly. We create a bot with web-scraping functionality and collect all

marriage records between 2001 and 2022, resulting in about 600,000 marriage records.

B. Sample Construction

After matching both spouses' names on marriage records to tax returns, we observe their

taxpayer identification numbers (usually Social Security numbers) and follow them over

time within the tax data. We primarily focus on the year of marriage to study newlywed

marital-status misreporting. This allows us to compare couples who are reacting to a new

required filing status, where some are compliant and others misreport. For each couple, the

year of legal marriage is:

C. Calculating Marriage Penalties

Calculating marriage penalties requires estimating counterfactual tax liabilities using a tax

calculator and counterfactual returns.

IV. Results

First, we report misreporting rates by marriage penalty levels and then show the sources of

marriage penalties and how they vary by the number of dependents. Next, we show the

strong correlation between EITC marriage penalties and misreporting rates, where both are

larger among spouses with similar earnings. Finally, we discuss how marriage penalties

among compliant and misreporting filers have changed over time with policy changes.

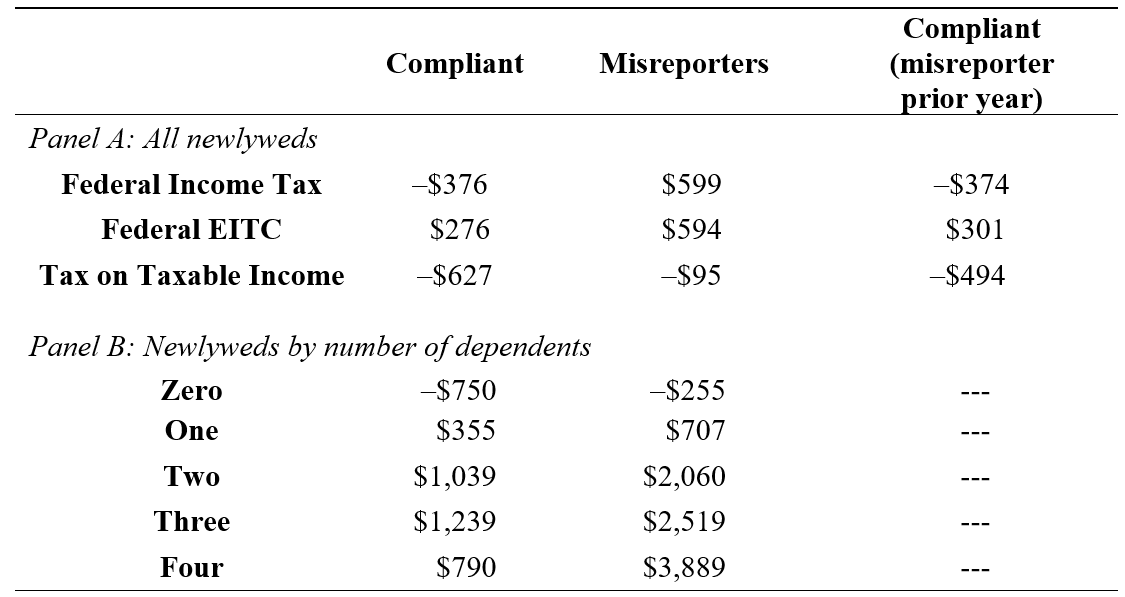

Table 1: Marriage penalties and bonuses: Newlyweds & prior-year misreporters

While average differences and the dose-response pattern both suggest strategic

misreporting, behavioral responses are also observed among misreporting couples who

eventually become compliant. The third column of Table 1 follows misreporters over time

until they file jointly, i.e., transition from misreporting to compliant (which takes an

average of just over two years). In the year a misreporting couple first files a compliant

joint return, we calculate an average marriage bonus of $374. In the year prior, during

which they still misreported, we calculate an average marriage penalty of $377. This

suggests misreporting couples become compliant immediately after their marriage

penalties decrease or become bonuses.

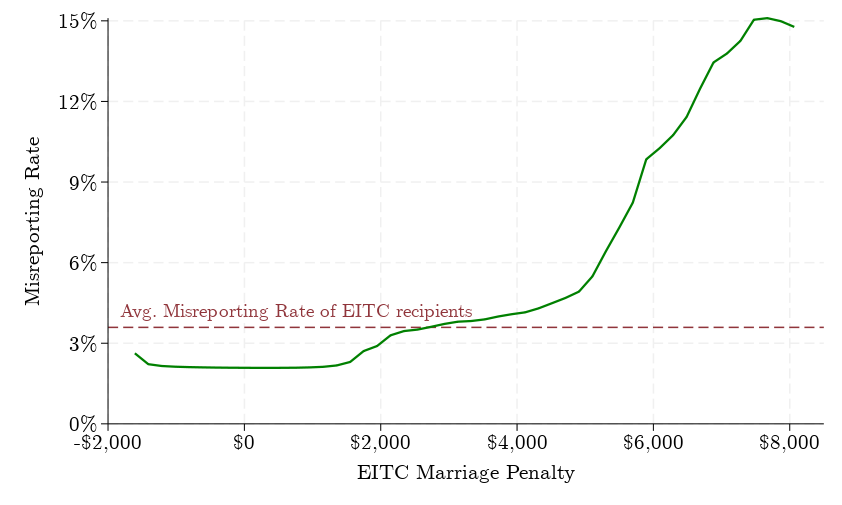

A. EITC Marriage Penalties and Marital-Status Misreporting

Marriage penalties among misreporters largely result from EITCs. The high salience of this

large, lump-sum refund can motivate behavior that protects it. Approximately 3.6% of

EITC-eligible newlyweds misreported their marital status, more than double the rate

(1.7%) among ineligible newlyweds. Figure 2A shows that misreporting rates also increase

with EITC marriage penalties. Misreporting rates increase from 4% for couples with EITC

marriage penalties of $3,000 to 10% for EITC marriage penalties of about $6,000.

Misreporting rates increase to over 15% for EITC marriage penalties over $7,000. This

parallels the pattern in Figure 1 for overall marriage penalties.15

Figure 2A: Marital-status misreporting rate by EITC marriage penalty, newlyweds in 2001-2022

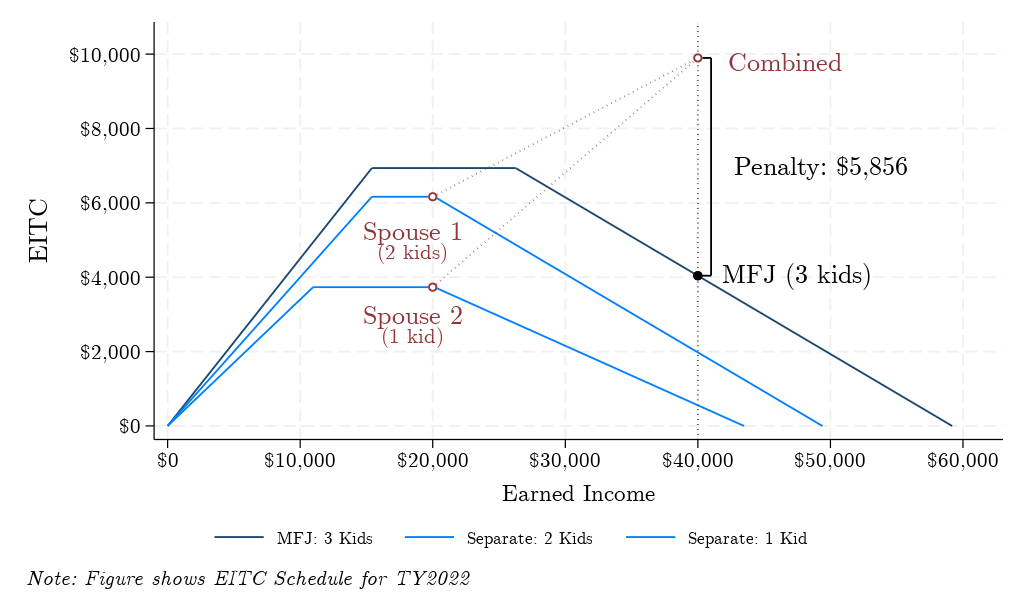

The EITC can generate substantial marriage penalties, particularly for dual-earner

couples with three qualifying children. Figure 2B illustrates this for a hypothetical couple

with a combined earned income of $40,000 from equal spousal earnings. Note that the

EITC schedule varies both by number of qualifying children and by filing status. By

misreporting and filing two head-of-household returns, a married couple would receive

$9,897 of EITCs: $6,164 from the spouse claiming two children (spouse 1) and $3,733

from the spouse claiming one child (spouse 2). But when filing jointly (MFJ), the couple

would have EITCs of only $4,041. This smaller credit is because the marginal benefit of

the first child is larger than the marginal benefit of the third child and because combining

incomes places the couple in the EITC phase-out range. In total, the marriage penalty

related to the EITC for this couple is nearly $6,000.

Figure 2B: EITC Marriage Penalty Example (2022 schedule)

As prior literature has noted, the EITC causes large marriage penalties among

similar-earning couples, especially when combined earnings are in the EITC phase-out

range (as in the example above and shown empirically in the appendix). To illustrate how

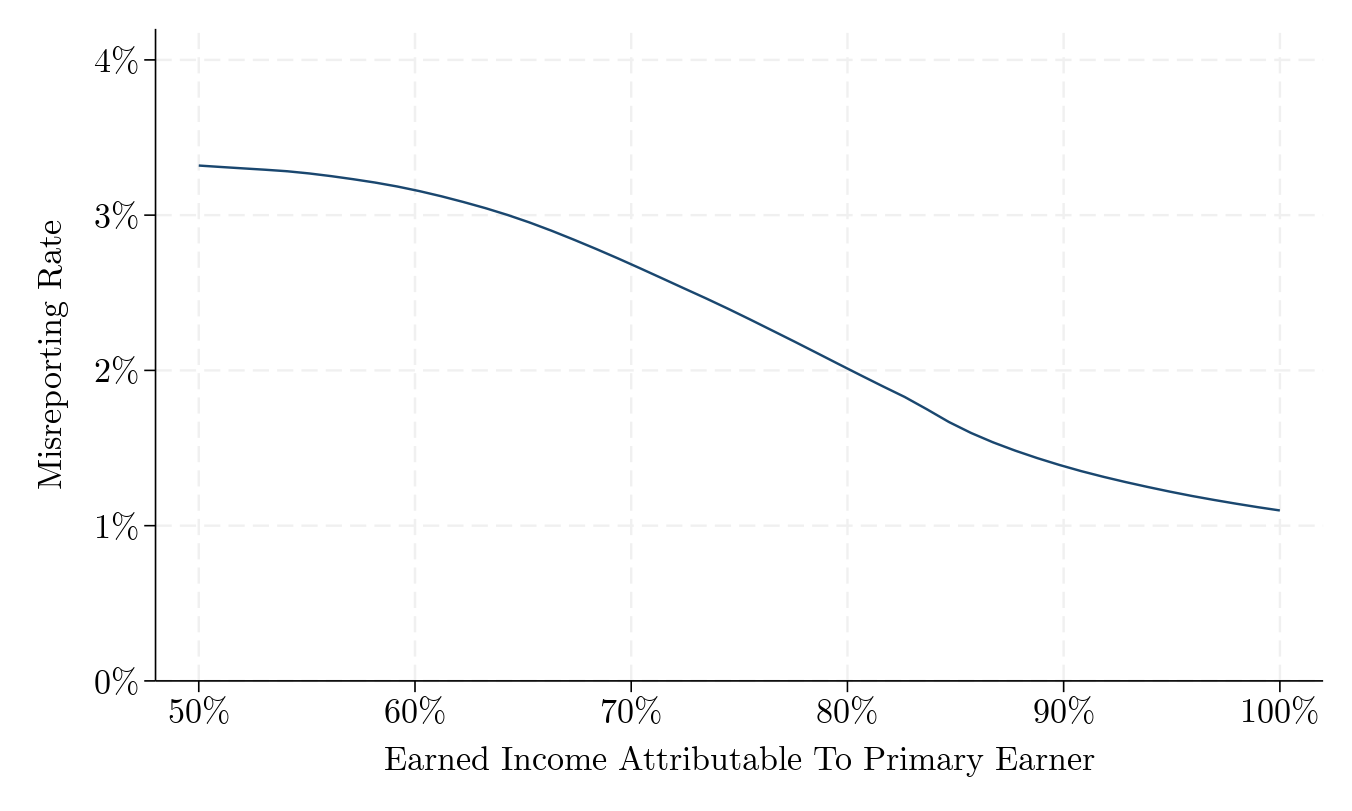

spousal income splits affect marital-status misreporting rates, Figure 2C ranks couples by

the share of earned income from the primary earner. Couples with equal earnings (left side

of figure) have the highest misreporting rates. As spousal earnings become less equal, the

EITC marriage penalty tends to fall and so do average misreporting rates.

Figure 2C: Marital-status misreporting by spousal earnings split, newlyweds in 2001-2022

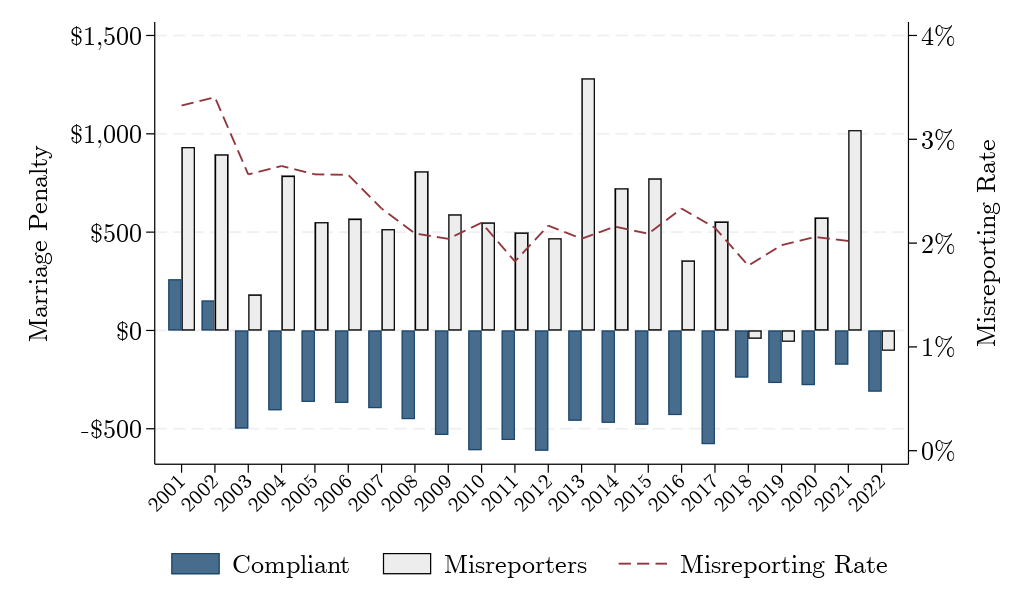

B. Marriage Penalties Year-by-Year

Marriage penalties among misreporters have been relatively stable over the last two

decades. Figure 3 shows misreporters' average marriage penalties are usually about $500

between 2001 and 2017. In 2018, however, misreporters started having small bonuses on

average, perhaps from the larger share of families with no income tax burden following the

Tax Cuts and Jobs Act (Splinter 2019). The higher 2020-2021 penalty levels are likely

related to the pandemic recession or temporary stimulus, which had a marriage penalty due

to the head-of-household income phase-out threshold being much higher than half that of

joint filers (Splinter 2023). For example, misreporting married couples with two children

could receive full stimulus payments for up to $250,000 of combined income by filing two

head-of-household returns, but full stimulus payments for only up to $150,000 of income

if filing jointly. Compliant newlyweds, in contrast, always had marriage bonuses on

average, except for 2001 and 2002, when they had small average penalties. This is likely

because 2003 tax policy changes lowered marriage penalties by accelerating the marriage

penalty relief started in 2001.16 Newlyweds responded to the 2003 marriage-penalty relief,

with their marital-status misreporting rate immediately decreasing nearly a percentage

point. This trend of decreasing misreporting rates continued through 2009, when the EITC

marriage penalty was reduced by expanding the income-range for the full EITC among

married filers.

Figure 3: Marital-status misreporting by spousal earnings split,

V. Discussion

Marital status affects federal income taxes. If a couple is married on the last day of the

year, they must file as married on their tax return. Some married couples, however, do not

file as married. We use tax data to investigate why couples misreport their marital status

on federal tax returns. Marital-status misreporting rates are higher among newlyweds with

larger marriage penalties. Also, misreporters who start correctly reporting their marital

status do so in the year that marriage penalties become marriage bonuses. Besides implying

marriage levels and patterns may have been mismeasured, our findings suggest prior work

estimating the effect of marriage penalties on the timing and prevalence of marriage could

be revisited. Our findings help reconcile the discrepancy between large marriage penalties

and small estimated marriage effects: couples subject to large marriage penalties can still

marry but avoid the tax consequences by not reporting their marriage to tax authorities.

Notes

William Gorman and David Splinter

September 2025 (pdf version)

While prior studies documented large marriage penalties, they also found that

penalties have limited impacts on couples getting or staying married (e.g., Alm and

Whittington 1999; Friedberg and Isaac 2024). Instead of considering the marriage margin,

we identify behavioral responses on the tax reporting margin. Tax incentives lead some

couples to proceed with their marital plans but then strategically misreport on tax returns

to avoid large marriage penalties.

We find that 2.3% of couples misreport their marital status in the year of marriage.

Newlyweds misreporting their marital status face an average federal-income-tax marriage

penalty of about $600. In contrast, correctly reporting newlyweds face an average marriage

bonus of nearly $400, which means reporting their marriage decreases these couples' taxes.

Additionally, misreporting rates increase with the size of the marriage penalty. Marital-status misreporting rates increase from 1.5% for couples with marriage bonuses to 4% for

couples with marriage penalties of $4,000 and to 14% for marriage penalties of about

$8,000 (Figure 1).1 This suggests newlyweds strategically misreport their marital status to lower their taxes or increase their credits.

Past research found that marriage penalties are larger among dual-earning couples

claiming dependents, especially among couples who claim the earned income tax credit

(EITC). Consistent with these incentives, we observe increased misreporting rates among

couples claiming dependents—especially among dual-earning couples with similar

earnings in the EITC income phase-out range. IRS (2014) estimates of filing-status errors,

mostly from married filers not filing as married, accounted for up to $3 billion of EITC

noncompliance. However, marriage penalty studies have ignored marital-status

misreporting, which could occur both in tax data and the survey data used in most prior

studies. Among the same individuals, there are large discrepancies between the marital

status reported in survey and tax data; over one-tenth of couples reporting being married

in surveys filed tax returns as unmarried (Mok 2017). To identify marriage misreporting,

we therefore use administrative marriage records.

This study has some limitations. First, we do not observe divorces, hence our

analysis focuses on marriage penalties that discourage reporting new marriages. Second,

our data-linking approach requires strict name matches for both spouses. This should avoid

false matches but results in over half of newlyweds not being linked to the tax data—although these omissions should result from missing middle names and largely random

differences in how names are spelled. A less restrictive approach capturing twice as many

matches shows higher misreporting rates (likely from false matches) but a nearly identical

pattern as Figure 1. Finally, the marriage records come from only one state: Minnesota.

This could limit generalizability, but the effects of state income taxes are relatively modest.

Marriage penalties often result from a couple having similar incomes, especially if

eligible for the EITC. Consider a couple with three EITC-eligible children in 2022 where

each spouse earns $20,000. Filing jointly, the couple's federal EITC would be about

$4,000. Had the couple misreported their marital status by filing two separate tax returns,

each with a head-of-household filing status, the couple's EITCs would instead total about

$10,000: over $6,000 from the spouse claiming two children and nearly $4,000 from the

spouse claiming one child (see Figure 2B). This dual-earner couple would receive about

$6,000 less in EITCs by filing jointly and, after accounting for the refundable child tax

credit phase-in threshold, would face a marriage penalty of about $5,500. This penalty is

nearly 15% of the couple's income.

Marriage bonuses, in contrast, often result from a couple having unequal incomes.

Consider a couple in 2022 composed of one spouse with no income and the other spouse

earning $100,000. Filing jointly, the couple has $74,100 of taxable income after deducting

their standard deduction and owes federal income taxes of about $8,500. Had the married

couple misreported by filing two single returns, the single-earner spouse would have

$87,050 of taxable income after deducting the smaller single standard deduction and would

owe about $14,800. The other spouse with no income would owe no income tax. This

single-earner couple owes $6,300 less in tax by filing jointly and therefore has a marriage

bonus of that amount.

The tax system is not marriage neutral—progressive taxation combined with joint

filing creates inherent marriage penalties and bonuses. Marriage neutrality would require

less tax progressivity (and no credit phase-outs) or eliminating joint filing that combines

spousal incomes.3 Given these tradeoffs, the federal tax system has alternated between

higher and lower marriage penalties and bonuses over time (Beebe 2019). Initially, only

taxpayers in community property states—where assets acquired by either spouse during

the marriage are considered jointly owned—could split income across two federal tax

returns, resulting in marriage bonuses in those states because all filers were subject to only

one set of tax brackets. In 1948, legislation extended these marriage bonuses to all federal

taxpayers by creating a married-filing-jointly status with double-sized tax brackets (Joint

Committee on Taxation 2001). Consistent with changes in tax policy, references in

historical print sources to the "marriage penalty" increased in 1945–1947, 1975–1985, and

1991–2001 (see online appendix). After each increase, there were notable declines

coinciding with reforms that mitigated marriage penalties: the 1948 universal incomesplitting legislation, the Tax Reform Act of 1986, and the 2001 and 2003 tax changes.4

2. Timing of marriage. Marriage penalties slightly delay the reported timing of

certain marriages. Sjoquist and Walker (1995) showed this with time-series data,

considering tax-sensitive marriage delays from the last quarter of one year to the first

quarter of the next year. Alm and Whittington (1995) used panel data, finding an elasticity

of short-term marriage delays with respect to marriage penalties of 0.78-1.54. Alm and

Whittington (1997) found that marriage penalties increased the probability of delaying

reported marriage timing by nearly 5%. Welfare eligibility rules may also affect the timing

of marriage (Alm, Dickert-Conlin, and Whittington 1999). Teitler et al. (2009) estimated

TANF participation delayed marriage by 12 to 16 months, but Isaac (2020) found little

effect on marriage or divorce.

3. Marriage rates. While this study focuses on the timing of reporting marriages,

the prior literature mostly examines the relationship between marriage penalties and

marriage formation rates. Using average marriage penalties, Alm and Whittington (1997)

found marriage penalties decreased marriage rates by about 2% in 1985. Alm and

Whittington (1999) emphasized that marriage penalties more strongly affected women's

marital decisions. Isaac and Jiang (2025) found small marriage formation responses to the

marriage bonuses and penalties in the Affordable Care Act. Holtzblatt and Rebelein (2000),

Lin and Tong (2012, 2014), and Maag and Acs (2015) considered cohabiting couples,

whose decision to marry may be sensitive to marriage penalties. For a broader review, see

Friedberg and Isaac (2024).

4. EITC. When spouses have more similar earnings, marriage penalties tend to

worsen. Couples with children are especially affected because of EITC phase-outs

(Congressional Budget Office 1997; Crandall-Hollick and Hughes 2018). Holtzblatt and

Rebelein (2000) found that EITCs increased marriage penalties by nearly one-tenth, mostly

from phase-outs. Although the EITC is usually associated with lower-income groups, the

larger penalties in the phase-out range imply EITC marriage penalties mostly affect middleincome couples. Dickert-Conlin and Houser (2002) and Isaac (2020) found few EITC

effects on marriage, but the latter study found that a more generous EITC encourages

lower-earning women to divorce. We find that EITC-claiming newlyweds are more likely

to misreport their marital status. This is consistent with interviews of EITC recipients, who

said marriage could "mess up" their tax refund; however, rather than forgoing marriage,

recipients admitted they (and their tax preparers) sometimes misreported marital status to

increase tax refunds (Edin, Tach, and Halpern-Meekin 2014).

5. Race. The sensitivity of marriage penalties to the similarity of spousal earnings

may create systematic differences in marriage penalties by race. Due to more similar earnings

among black spouses, marriage penalties tend to be worse for this group, at least in studies

using survey data (Brown 2021; Alm, Leguizamon, and Leguizamon 2023; Holtzblatt et

al. 2024). Using tax data, however, Costello et al. (2024) found that nearly all income

groups below $200,000 had lower marriage penalty rates for black joint filers than for

white joint filers. They suggested this different result was from many more marriages being

reported in survey data than tax data.

6. Tax Noncompliance. IRS (2024) estimated filing status errors explain $7 billion

of noncompliance and show noncompliance rates by type of income. Our average maritalstatus misreporting rate of about 2% suggests newlyweds misreport their marriage at rates

similar to the noncompliance rate of wages, which have substantial information reporting.

But for newlyweds subject to large marriage penalties, the marital-status misreporting rate

can reach the 15% noncompliance rate for income subject to only some third-party

information reporting (e.g., partnership income), although well below the 55%

noncompliance rate for income with little or no information reporting (e.g., sole proprietor

income). Marital-status misreporting rates among those with tax penalties are therefore

usually below misreporting rates for other forms of noncompliance.

Misreported filing status was the third-largest reason for estimated EITC

noncompliance in 2006–2008, accounting for up to $3.3 billion annually in tax credit

overclaims (IRS 2014).5 This filing-status noncompliance was mostly from married

taxpayers incorrectly filing as unmarried, as nearly one-tenth of EITC claimants with

children likely misreported their marital status.6 We find that large credit overpayments

from marital status noncompliance can persist for many years. The weak enforcement

against this form of noncompliance occurs because the IRS does not observe up-to-date

marital status, which is administered at the state and local levels, and therefore the IRS

only corrects this noncompliance through resource-intensive audits. If misreporting

noncompliance is sensitive to increased information reporting—as are other forms of

noncompliance—then information reporting could mitigate marital-status misreporting.

Additionally, if the IRS had up-to-date marriage-status data, it could use marital-status

misreporting as part of its e-filing rejection criteria.7

National estimates using administrative records only report annual flows of

marriages and divorces. There are no parallel administrative estimates of the stock of

overall marriages, which require tracking each individual's marriages, divorces,

immigration, emigration, and death over time. Although marriage and divorce data are

collected at the state and local level, these data are not aggregated and therefore multi-year

tracking is generally not feasible. We address this data limitation by focusing on

newlyweds and using administrative marriage records. Publicly available marriage records,

however, do not include Social Security Numbers. We therefore develop a matching

algorithm based on spousal names. This resembles the method used by Census to link tax

and survey data using Protected Identification Keys and the Splinter et al. (forthcoming)

matching of tax data to loan data by business name. However, we do not observe divorces

and therefore limit our main estimates to newlyweds.

Tax data include extensive demographic information, such as name, sex, taxpayer

identification number, and mailing address. Marriage records only include the county of

marriage, certificate number, date of marriage, and the full names of both spouses. This

leaves limited options to link these data. The location of a marriage may not determine

where a couple files their taxes, the certificate number is only for internal use, and maritalstatus misreporting on tax returns means the dates of marriage cannot be used for linking. Therefore, we rely solely on names to link marriage records to tax data.

In the marriage records, names appear in two fields: "LAST" and "FIRST MIDDLE".

To prepare the second field for matching, we classify the first name as all characters before

the first space, and the middle initial as the first character after the space. In the tax data, if the names of a fictional couple are "JANE H DOE" and "JOHN G DOE" then their names

are usually recorded as "JANE H & JOHN G DOE" when filing jointly. For the first

spouse, we classify the first name as all characters before the first space, the middle initial

as the first character after the first space, and the last name as all characters after the last

space. For the second spouse, we classify the first name as all characters between the "&"

and second-to-last space, the middle initial as the first character after the second-to-last

space, and the last name as all characters after the last space.

To link marriage records to tax returns, we use a strict-name match, employing both

spouses' full names including middle initials. We require an exact match to the first name

and middle initial of both spouses, along with an exact match to one last name, which

allows for last-name changes upon marriage. Because we rely on both spouses' names, the

couple must have filed a joint or married filing separately tax return at some point to be

matched. For this purpose, we use the tax return (from tax years 2001 to 2024) that is the

first year a couple filed with a married filing status (married filing jointly or married filing separately). This implies that we do not match a couple's marriage record to their tax

returns if there is (a) any deviation in spelling of the first name or middle initial for either

spouse, (b) any deviation in spelling of the last name on the joint return, (c) a middle name

is not provided, (d) the last name contains a suffix, such as "JR" or "III", or (e) the couple

has never filed as married. The strict-name approach matches 36% of newlyweds in 2001-

2022 Minnesota marriage records to their federal tax returns. Unmatched marriages are

from spouses never filing a married return by 2024 or without middle names, as well as

differences in names in the two datasets (e.g., misspellings, nicknames, suffixes, or data

errors), which should be uncorrelated with marriage penalties. The online appendix shows

that misreporting rates appear to be largely random with respect to the year and month of

marriage (except for December marriages) and the county of marriage. The match

identifies 214,443 couples.9

1. The first year they file taxes as married (compliant)

2. Before they first file taxes as married (delayed reporter)

3. After they first file taxes as married (early reporter)

Delayed reporters represent 2.3% of newlyweds, while early reporters represent 1.4%. Our

estimates focus on the more common form of marital-status misreporting, that due to

delayed marriage reporting. The online appendix discusses early reporters, who have

larger-than-average marriage bonuses. To ensure comparability and accurate marriage

penalty estimates, we drop early reporters and couples where neither spouse filed an

individual income tax return. We do allow for couples where only one spouse filed a return

and the other was a non-filer. Implementing these restrictions narrows our dataset to

208,602 couples. Table A1 shows misreporting and compliant newlyweds are similar

across various characteristics when both spouses file, although misreporters tend to have

more dependents and face marriage penalties. Misreporting newlyweds where one spouse

is a non-filer are generally lower-income, single-earner couples facing (but not receiving)

marriage bonuses, although missing non-filer income may bias estimates among this group.

1. Tax Calculator. We use the TAXSIM calculator from the National Bureau of

Economic Research to estimate tax liabilities for both actual and counterfactual returns

using about three dozen variables. The federal income tax liability amounts in the tax data

are replaced with calculated tax liabilities to ensure a common baseline. The calculated

federal income tax liabilities deviate from reported liabilities in the tax data by a median

of $654 (mean of $2,135) and from reported EITCs by a median of $0 (mean of $107).

These differences can result from tax calculator simplifications, especially for high-income

returns.10

2. Counterfactual Returns. To estimate marriage penalties, the combined tax

liability of a couple's two separate tax returns needs to be compared to the tax liability of

a joint tax return, where one is a simulated counterfactual. Different approaches are

required to create counterfactual returns based on whether a couple filed as unmarried

(misreported) or filed as married (compliant). For misreporting married couples, a

counterfactual joint return is constructed by summing items (income, itemized deductions,

dependents, etc.) across the two observed returns. If one of the spouses was a non-filer, a

counterfactual single return is first constructed for the non-filer and then a counterfactual

joint return is constructed for the couple, where the non-filer's income items are retrieved

from Form W-2 wages, Form 1099-MISC/NEC nonemployee compensation, and Form

SSA-1099 Social Security and disability benefits.

For compliant spouses filing jointly, the one joint return needs to be split into two

counterfactual separate unmarried returns. Whereas combining misreporting returns is

straightforward, dividing the components of compliant returns is less so. We start by

applying a data-informed approach to allocate certain income sources. Wages are allocated

based on individual Form W-2 wages. For example, if the primary filer earns 80% of the

couple's combined Form W-2 wages, then that share of the couple's wage amount reported

on their tax return is allocated to the primary filer and the remaining to the secondary filer.

Sole proprietorship income and farm income are allocated based on Schedules C and F,

which are attributable to only one of the two filers, as this income is subject to individual

self-employment taxes. Remaining taxable income sources, such as capital income and

deductions, are allocated 60% to the primary filer and 40% to the secondary filer. While

information returns could inform the capital income attributable to each spouse, the

individuals listed for these information returns provide an imperfect measure of how much

each spouse would claim had they filed individually. Finally, dependents are split evenly

between spouses, with the oldest going to the primary filer. When there are an odd number

of dependents, the primary filer is allocated the additional dependent. These assumptions

likely result in an overly equal split of income, which decreases the average compliant

marriage bonus and suggests that the average federal marriage penalty gap between

compliant and misreporters could be larger than our estimate of $1,000.

Delayed reporting of marriages is consistent with strategic tax minimization (and

credit maximization). The overall newlywed marital-status misreporting rate was 2.3%.

But the misreporting rate was only 1.5% for couples with marriage bonuses and 3.3% for

couples with marriage penalties.11 Besides this average difference, misreporting rates

increase as marriage penalties increase. Figure 1 shows the misreporting rate of 4.3% for

couples with a marriage penalty of $4,000 increases to 8.2% for couples with a marriage

penalty of $6,500 and then increases to 14% for couples with a marriage penalty of around

$8,000.12 When marriage penalties are measured as a percent of income, misreporting rates

increase in a similar pattern. Compared to under 2% for couples with no marriage penalty,

the misreporting rate doubles to 4% when penalties reach two percent of income and

doubles again to 8% when penalties reach eight percent of income. See the online appendix

for details, as well as evidence that the lowest-income group has the highest marital-status

misreporting rate.13

Compliant newlyweds tend to have marriage bonuses, while misreporting

newlyweds tend to have marriage penalties. Table 1 shows that compliant newlyweds

received an average marriage bonus of $376, but misreporters faced an average marriage

penalty of $599. This main analysis only considers federal income taxes, but adding state

income taxes reinforces the main finding, increasing the average gap between compliant

and misreporting newlyweds from $975 to $1,225.

The overall federal income tax impacts largely result from the EITC (second row

of Table 1) and tax on taxable income (third row of Table 1). Among compliant reporters,

the overall marriage bonus includes $276 of EITC marriage penalties, which are more than

offset by $627 of taxable-income marriage tax bonus. Among misreporters, the overall

marriage penalty includes $594 of EITC marriage penalties that are only modestly offset

by $95 of taxable-income marriage tax bonus. As EITC marriage penalties explain nearly

all of misreporters' penalties, the EITC is likely the driver of misreporting.

Marriage penalties also vary with the number of dependents (Table 1, Panel B).

Among those with no children, compliant newlyweds face an average marriage bonus of

$750, while misreporting newlyweds face an average marriage bonus of $255. As couples

with no dependents have few EITCs, the zero-dependent group largely isolates the effects

of spousal earnings similarity on marriage bonuses. Childless couples with unequal spousal

earnings can receive large marriage bonuses by being compliant, while childless couples

with similar spousal earnings usually have smaller bonuses.14 Among those with children,

compliant newlyweds have average marriage penalties of about $400 per dependent

(ignoring those with four dependents), but misreporting newlyweds face average marriage

penalties of about $1,000 per dependent. This difference should largely reflect self selection, as those facing larger marriage penalties are more likely to misreport. Among

misreporters, the marriage penalty increase associated with additional dependents is

enabled by EITC policy. In 2022, maximum EITCs increase by about $3,200 for the first

child, $2,400 for the second child, and $800 for the third child. Misreporting increases total

EITCs by splitting dependents across two returns to take advantage of the larger first-child

and second-child credits.

newlyweds in 2001-2022

2. However, a married person may file as head-of-household under specific circumstances, such as living apart from their spouse while maintaining a home for a child. A surviving spouse can still file as married filing jointly for the year their spouse died.

3. Many countries have individual-level (as opposed to joint) filing of tax returns, but these systems are not necessaril ymarriage neutral, as couples may shift asset-based income to spouses with lower marginal tax rates (Stephens and Ward-Batts 2004). Other research found that female labor force participation increases with individual-level taxation (Doorley, Simon, and Tuda 2025) or a secondary-earner deduction (Bronson, Haanwinckel, and Mazzocco 2024).

4. "The legislation passed in 2001 and 2003...was geared towards reducing the marriage penalty in low-income households...[It] increased the width of the 10 percent and 15 percent tax brackets for joint filers to twice the width of the bracket for single filers, and increased the standard deduction to double that of single filers." (Bryant et al. 2008, p. 195)

5. This is the upper bound estimate. Lower bound assumptions and removing other possible noncompliance sources lowers the estimate to $1.3 billion, while accounting for filing-status noncompliance not detected by auditors would increase the estimate. The two largest sources of EITC noncompliance are income misreporting, e.g., income bunching at tax-credit-maximizing incomes (Mortenson and Whitten 2020), and qualifying child errors. The latter could result from strategic child reallocations (Tong 2014; Splinter, Larrimore, and Mortenson 2017).

6. "9 percent of those filing as head-of-household are estimated to have the correct status of married-filing-separately, making them ineligible for the credit." (IRS 2014, p. 35)

7. A similar issue occurs for dependents claimed on two returns, as the IRS does not have up-to-date information on child residency and support, although e-file rejections are often applied to double-claimed dependents (Gorman, McGuire, and Splinter forthcoming).

8. This 10% estimate of net marriage-rate overreporting in survey data is based on 62 million marriages in survey data versus 56 million marriages in tax data for 2010. This nets out marriages on tax returns among those not married in survey data. See appendix Table A2 of Mok (2017). Marriages may be overreported in surveys when couples who plan to marry already identify as married, or when legally unmarried couples consider themselves married, perhaps due to notions of common-law marriage or after a non-legal ceremony.

9. To match more marriage records to tax returns, we considered two alternative approaches: (1) dropping all suffixes in both the marriage records and tax returns, which increases the match rates by less than 1%, and (2) removing the middle-name requirement, which more than doubles the match rate. However, the latter approach often results in multiple couples for each marriage record, increasing the false positive rate. As such, our baseline estimates apply the strict-name match. Still, the higher match rate gives similar results as in Figure 1 (see the online appendix).

10. These differences are of absolute values and similar to those in Meyer et al. (2022), where tax data are also entered into TAXSIM.

11. The 1.5% misreporting rates for newlyweds with marriage bonuses suggests a modest baseline rate of unintentional errors. However, married couples with small marriage bonuses may still have an overall incentive to misreport their marital status due to marriage increasing minimum student loan payments or decreasing government benefits.

12. Misreporting rates decline slightly when penalties exceed $8,500, roughly the maximum EITC marriage penalty. Under that threshold, about 60% of marriage penalties are from EITCs, while over it just one-third are from EITCs.

13. This is consistent with evidence that forgone tax savings are larger for higher-income taxpayers with higher opportunity costs (Benzarti 2020).

14. Section I showed that a couple with only one spouse earning $100,000 had a marriage bonus of about $6,300. But if that income was split equally, with each spouse earning $50,000, there would be no marriage bonus or penalty.

15. In 2022, the maximum EITC marriage penalties for couples with one, two, three, and four children were: $3,733, $5,026, $6,872, and $8,342. These maximums occur when total earnings of compliant joint returns phase out all EITCs and likely explain the misreporting peak in Figure 1.

16. Carasso and Steuerle (2002) found that the 2001 reform meant "two-children couples earning $15,832-$32,121 receive $577 in [EITC] marriage penalty relief" and child tax credit marriage penalties decreased by $800 for this income group. We observe a 2001 to 2003 marriage penalty decrease of about $800 among compliant newlyweds.

References

- Alm, James, Stacy Dickert-Conlin, and Leslie A. Whittington. 1999. Policy Watch: The Marriage Penalty. Journal of Economic Perspectives 13 (3): 193-204.

- Alm, James, J. Sebastian Leguizamon, and Susane Leguizamon. 2023. Race, Ethnicity, and Taxation of the Family: The Many Shades of the Marriage Penalty/Bonus."National Tax Journal 76 (3): 525-60.

- Alm, James, and Leslie A. Whittington. 1995. Does the Income Tax Affect Marital Decisions? National Tax Journal 48 (4): 565-572.

- Alm, James, and Leslie A. Whittington. 1997. Income Taxes and the Timing of Marital Decisions. Journal of Public Economics 64 (2): 219-240.

- Alm, James, and Leslie A. Whittington. 1999. For Love or Money? The Impact of Income Taxes on Marriage." Economica 66 (263): 297-316.

- Beebe, Joyce. 2019. "The Marriage Penalty After the TCJA: Effects on High- and Low-Income Households and the Elderly." Baker Institute, Center for Tax and Budget Policy Report.

- Benzarti, Youssef. 2020. "How Taxing Is Tax Filing? Using Revealed Preferences to Estimate Compliance Costs." American Economic Journal: Economic Policy 12 (4): 38-57.

- Bowmaker, Simon W., and Patrick M. Emerson. 2015. "Bricks, Mortar, and Wedding Bells: Does the Cost of Housing Affect the Marriage Rate in the US?" Eastern Economic Journal 41 (3): 411-429.

- Bronson, Mary Ann, Daniel Haanwinckel, and Maurizio Mazzocco. 2024. "Taxation and Household Decisions: An Intertemporal Analysis." NBER working paper No. 32861.

- Brown, Dorothy A. 2021. The Whiteness of Wealth. New York: Crown Publishing Group.

- Bryant, Victoria L., Leslie Countryman, John W. Diamond, and Trang Dinh. 2008. "Marriage Penalty Relief in the 2001 and 2003 Tax Cuts: Implications for Horizontal Equity." Proceedings of the 101st Annual Conference of the National Tax Association.

- Bull, Nicholas, Janet Holtzblatt, James R. Nunns, and Robert Rebelein. 1999. "Defining and Measuring Marriage Penalties and Bonuses." U.S. Department of the Treasury, Office of Tax Analysis. Working Paper 82.

- Carasso, Adam, and C. Eugene Steuerle. 2002. "Saying 'I Do' after the 2001 Tax Cuts." Tax Policy Center.

- Chiocchio, Francesco. 2025. "Marital Decline: The Role of House Prices and Parental Coresidence." Working paper.

- Congressional Budget Office. 1997. "For Better or For Worse: Marriage and the Federal Income Tax." Washington, DC: CBO.

- Costello, Rachel, Portia DeFilippes, Robin Fisher, Ben Klemens, and Emily Y. Lin. 2024. "Marriage Penalties and Bonuses by Race and Ethnicity: An Application of Race and Ethnicity Imputation." AEA Papers and Proceedings 114: 644-648.

- Crandall-Hollick, Margot, and Joseph Hughes, 2018. "The EITC: An Economic Analysis." Congressional Research Service Report R44057.

- Dickert-Conlin, Stacy, and Scott Houser. 2002. "EITC and Marriage." National Tax Journal 55(1): 25-40.

- Doorley, Karina, Agathe Simon, and Dora Tuda. 2025. "From Joint to Individual: The Distributional and Labour Supply Effect of Tax Individualisation in Ireland." IZA working paper No. 18035.

- Edin, Katharine, Laura Tach, and Sarah Halpern-Meekin. 2014. "Tax Code Knowledge and Behavioral Responses Among EITC Recipients, Policy Insights from Qualitative Data." Journal of Policy Analysis and Management 33 (2): 413-439.

- Fisher, Robin. 2023. "Estimation of Race and Ethnicity by Re-Weighting Tax Data." Office of Tax Analysis Technical Paper 11.

- Friedberg, Leora, and Elliott Isaac. 2024. "Same-Sex Marriage Recognition and Taxes: New Evidence about the Impact of Household Taxation." The Review of Economics and Statistics 106 (1): 85-101.

- Gorman, William, Jamie McGuire, and David Splinter. Forthcoming. "Double-Claimed Dependents: Did E-Filing Lower U.S. Tax Noncompliance?" International Tax and Public Policy.

- Hayford, Sarah R., Karen Benjamin Guzzo, and Pamela J. Smock. 2014. "The Decoupling of Marriage and Parenthood? Timing of Marital First Births, 1945-2002. Journal of Marriage and Family 76 (3): 520-538.

- Holtzblatt, Janet, Swati Joshi, Nora R. Cahill, and William Gale, 2024. "Racial Disparities in the Income Tax Treatment of Marriage." Tax Policy and the Economy 38: 25-60.

- Holtzblatt, Janet, and Robert Rebelein. 2000. "Measuring the Effect of the EITC on Marriage Penalties and Bonuses." National Tax Journal 53 (4): 1107-1133.

- IRS. 2014. "Compliance Estimates for the Earned Income Tax Credit Claimed on 2006-2008 Returns." Publication 5162 (8-2014).

- IRS. 2024. "Tax Gap Projections for Tax Year 2022." Publication 5869 (Rev. 10-2024).

- Isaac, Elliott. 2020. "Marriage, Divorce, and Social Safety Net Policy." Southern Economic Journal 86 (4): 1576-1612.

- Isaac, Elliott, and Haibin Jiang. 2025. "Tax-Based Marriage Incentives in the Affordable Care Act." National Tax Journal 78 (2): 369-413.

- Joint Committee on Taxation. 2001. "Overview of Present Law and Economic Analysis Relating to the Marriage Tax Penalty, The Child Tax Credit, and The Alternative Minimum Tax." JCX-8-01.

- Kearney, Melissa. 2025. The Two-Parent Privilege: How Americans Stopped Getting Married and Started Falling Behind. Chicago, IL: University of Chicago Press.

- Lin, Emily, and Patricia Tong. 2012. "Marriage and Taxes: What Can We Learn from Tax Returns Filed by Cohabiting Couples?" National Tax Journal 65 (4): 807-826.

- Lin, Emily, and Patricia Tong. 2014. "Effects of Marriage Penalty Relief Tax Policy on Marriage Taxes and Marginal Tax Rates of Cohabiting Couples." National Tax Association Proceedings from the 107th Annual Conference.

- Maag, Elaine, and Gregory Acs. 2015. "The Financial Consequences of Marriage for Cohabitating Couples with Children." Urban Institute.

- Meyer, Bruce D., Derek Wu, Grace Finley, Patrick Langetieg, Carla Medalia, Mark Payne, and

- Plumley, Alan. 2022. "The Accuracy of Tax Imputations: Estimating Tax Liabilities and Credits Using Linked Survey and Administrative Data." In Raj Chetty, John N. Friedman, Janet C. Gornick, Barry Johnson, and Arthur Kennickell (eds.), Measuring Distribution and Mobility of Income and Wealth. Cambridge, MA: NBER. 459-498.

- Mok, Shannon. 2017. "An Evaluation of Using Linked Survey and Administrative Data to Impute Nonfilers to the Population of Tax Returns Filers." CBO working paper 2017-06.

- Mortenson, Jacob A., and Andrew Whitten. 2020. "Bunching to Maximize Tax Credits: Evidence from Kinks in the US Tax Schedule." American Economic Journal: Economic Policy 12 (3): 402-432.

- Sjoquist, David L., and Mary Beth Walker. 1995. "The Marriage Tax and the Rate and Timing of Marriage." National Tax Journal 48 (4): 547-558.

- Smith, Reginald D. 2019. "Marital Fertility Patterns and Nonmarital Birth Ratios: An Integrated Approach." Genus 75: 9.

- Splinter, David, Jeff Larrimore, and Jacob Mortenson. 2017. "Whose Child Is This? Shifting of Dependents Among EITC Claimants" National Tax Journal 70 (4): 737-758.

- Splinter, David. 2019. "Who Pays No Tax? The Declining Fraction Paying Income Taxes and Increasing Tax Progressivity." Contemporary Economic Policy 37 (3): 413-426.

- Splinter, David. 2023. "Stimulus Checks: True-Up and Safe-Harbor Costs." National Tax Journal 76(2): 349-366.

- Splinter, David, Eric Heiser, Michael Love, and Jacob Mortenson. Forthcoming. "The Paycheck Protection Program: Progressivity and Tax Effects." National Tax Journal.

- Stephens, Melvin Jr., and Ward-Batts, Jennifer. 2004. "The Impact of Separate Taxation on the Intra-Household Allocation of Assets: Evidence from the UK." Journal of Public Economics 88 (9-10): 1989-2007.

- Teitler, Julien O., Nancy E. Reichman, Lenna Nepomnyaschy, and Irwin Garfinkel. 2009. Effects of Welfare Participation on Marriage. Journal of Marriage and Family 71 (4): 878-891.

- Tong, Patricia K. 2014. Tracking EITC Qualifying Children Over Time. National Tax Association Proceedings from the 107th Annual Conference.